Fees and Payments

Course fee and financial assistance information for Domestic and International students.

2024 Fee Schedule

The Fee Schedule is a guide to course and unit fees. It outlines each ACAP course on offer, including information on units, student load and credit points. It also includes fee information for higher education courses. Courses may not be available at all campuses, or in all trimesters.

For full information about courses, please refer to course pages.

Tuition Fees and Payments

ACAP offers a range of tuition fee payment options such as FEE-HELP and Full Upfront Payments.*

You can select a payment option during the admission process, and if your circumstances change, you can request to change this method during your studies. Please note that the fees listed are indicative total course fees. Pricing of each unit of study may increase from time-to-time and does not take into account personal circumstances such as recognition of prior learning, credit or repeating a unit.

*No new students will be approved for a VET student loan (VSL)

KEY DATES AND Census Date

You should familiarise yourself with key date, particularly the census date. The census date is important as it is the last day you can:

- submit your form to access a FEE-HELP loan, or

- withdraw/cancel your enrolment in your course in full or in part without incurring the cost, debt, academic penalty for any currently enrolled subject or unit (see Enrolment Rules for procedures on varying, withdrawing or cancelling your enrolment).

This date varies across courses and trimesters. You can view the Census Dates on ACAP’s key dates page.

Census date is your last opportunity to withdraw from your course without facing financial or academic penalty.

To withdraw prior to census:

- Domestic students call 1800 039 139 or book a call back.

- International please email [email protected] or book a call back.

Domestic Student Tuition Fees and Payments

A Domestic student is a student who is an Australian citizen, a New Zealand citizen, an Australian Permanent Resident or the holder of an Australian permanent humanitarian visa.

Tuition fee payment options for Domestic students include the following:

- Upfront payment of fees due at the start of a program or course.

- Payment of remaining fees as outlined in the tuition fee invoice issued each trimester, due by the first day of that trimester.

- FEE-HELP (for approved programs and eligible students only).

2022 DOMESTIC AND INTERNATIONAL FEE SCHEDULE

2023 DOMESTIC AND INTERNATIONAL FEE SCHEDULE

International Student Tuition Fees and Payments

An International Student is a holder of an International Student Visa. Tuition fee payment options for International students include the following:

- First trimester tuition fees should be paid at the time of lodging the student admission agreement. An eCoE will then be issued on receipt of the first instalment.

- Payment of remaining fees as outlined in the tuition fee invoice, issued each study period, is due by the first day of that study period.

2022 DOMESTIC AND INTERNATIONAL FEE SCHEDULE

2023 DOMESTIC AND INTERNATIONAL FEE SCHEDULE

- Enrolment Fee (one-off, international students only): $250

A non-refundable enrolment fee is payable with all international student applications.

- Graduation (academic dress hire and ceremony tickets): See graduation page here.

- Textbooks: View the recommended textbook list and where to purchase them here.

- Library fees: View information on library fees here.

Alumni: Replacement of Documentation

All graduating students will receive a Graduating Pack, which contains official documentation of their Statement of Attainment, Statement of Results and Testamur. This Graduation pack is either presented at a Graduation ceremony or sent to the students home address at no cost to the student as recognition of their remarkable achievement.

If a replacement is required after twelve (12) months of graduating the following cost will be incurred:

- Replacement Statement of Attainment: $30 per copy

- Replacement Statement of Results: $30 per copy

- Replacement Testamur: $30 per copy

Please email [email protected] with your request.

What is FEE-HELP?

FEE-HELP is a Commonwealth Government loan available to eligible students enrolled in ACAP’s Higher Education courses to help pay part or all of their tuition fees. A 20% loan fee (from 25% prior to 2022) applies to undergraduate courses that lead to the award of a higher education diploma, advanced diploma, associate degree or a bachelor degree (pass, honours, or graduate entry). The Australian Government has extended the FEE-HELP loan fee exemption to 31 December 2022. This means that the loan fee amounts will be removed from students’ combined HELP debt statements for any units with a census date in 2022. From January 1, 2023, the 20% loan fee will apply to most students who pay for their undergraduate courses with a FEE-HELP loan.

Detailed information, the 2024 HELP factsheets and the HELP Booklets about accessing FEE-HELP are available at the Study Assist website.

Who is entitled to FEE-HELP?

To be entitled, students must be:

- an Australian citizen and study at least part of your course in Australia

- a New Zealand Special Category visa (SCV) holder or permanent humanitarian visa holder and meet the residency requirements

- a permanent visa holder who is undertaking bridging study for overseas-trained professionals and will be a resident in Australia for the duration of the study

- a pacific engagement visa holder who is a resident in Australia for the duration of your unit (s), from 1 February 2024

- enrolled in an eligible unit of study by the census date for that unit

- have an available HELP balance

Note: The Higher Education Support Act 2003 has been amended to remove the requirement that students must pass 50 per cent of the units they study to remain eligible for Commonwealth assistance in the form of a HELP loan. Students enrolled in units of study with census dates on or after 1 January 2024 will not need to meet the pass rate requirements.

What is a lifetime loan limit?

The lifetime loan limit is the total amount you can incur in your lifetime under any Commonwealth student loan scheme, whether Higher Education FEE-HELP or a VET Student Loan. It is indexed each year in line with the Consumer Price Index (CPI). For example, in 2022, the lifetime loan limit is $109,206 for most students.

You can check your HELP balance on myHELPbalance.

A student will commence repaying any FEE-HELP loan through the Australian Taxation Office once their income reaches the minimum threshold for compulsory repayment ($47,014 per annum 2021-2022). Click for more information on loan repayment.

How to apply for FEE-HELP?

To apply for FEE-HELP, you will need to read the FEE-HELP information booklet. The booklet offers students information about each of the HELP loans under HELP Fact sheets.

If you are eligible and would like to defer your fees through FEE-HELP, you need to complete the online form via the eCAF system before the census date. eCAF applications will be emailed to students once the enrolment process is complete and all eligibility documents provided.

If you wish to apply, please contact and advise the Admissions Team via email [email protected].

Unique Student Identifier (USI)

The Unique Student Identifier (USI) is a reference number made up of ten numbers and letters and will stay with you for life.

If you are commencing your studies in 2021, you will need to provide your USI as part of your enrolment process. In addition, if you seek Commonwealth financial assistance (FEE-HELP), you must provide your USI on your electronic Commonwealth Assistance Form (eCAF).

From 1 January 2023, all students must have a USI to graduate and receive their qualification or statement of attainment. This includes all students who started before 2021, as well as all international students studying onshore.

It is free and easy to create your USI. Please visit the Unique Student Identifier website to get your USI.

STUDENT FEE PAYMENT METHODS

A Provisional Invoice is available on the Student Portal under the Documentation – Financial. You can view your current balance on Invoices & Payment Options before you make a payment.

Pay via our online payment portal

ACAP accepts various payment options through the ACAP Payment Portal, powered by our official payment partner – Flywire.

This portal allows you to:

- Execute, track and confirm your payment online in a secure portal

- Use familiar payment options from your home country, in 140+ currencies

- Access a 24/7 multilingual customer support team for assistance

- Save on bank fees and ensure the best exchange rates with Flywire’s best price guarantee.

How to make a payment to ACAP

- Go to ACAP Payment Portal to begin your payment.

- Select the country from where you are paying and your preferred payment method.

- Enter your payment details and confirm your payment booking.

- Receive instructions on how to complete the payment process, depending on your payment method.

- Once payment is made you will have access to real-time payment tracking through email, in-app and text alerts

Watch these videos to find out more about Flywire

How to make a payment using Flywire

How to make an International Bank Transfer using Flywire

Having trouble with Flywire?

Email: [email protected]

Phone: +61 2 8311 4772

International Phone Numbers & FAQs: flywire.com/support

UPFRONT PAYMENT

ACAP accepts full or partial upfront payment of your trimester tuition fees via our ACAP Payment Portal. The amount payable will be included on your invoice each term and must be paid in full before the commencement of each trimester.

Failure to pay tuition fees by the due date will impact your ability to continue to study. Also, any unpaid tuition fees may affect international students’ confirmation of enrolment (CoE) and student visa status with the Department of Home Affairs.

Please note you will not be eligible to graduate until you have completed all required course components (see course structure information provided on the ACAP website for your course) and have no outstanding debts with us.

Students can apply for a refund of upfront tuition fees and, or remission of FEE-HELP/VET Student Loan under special circumstances.

This application is only relevant to modules that have not been completed. You cannot apply for re-credit or refund under special circumstances if you have completed the module. Click here to find how to cancel your HELP debt under ‘special circumstances’.

It would help if you also familiarise yourself with ACAP’s Tuition Fee and Refund Policy and Re-crediting of HELP Balance Policy and Procedure.

Tuition Protection protects all domestic students at private higher education providers against default, whether the students pay their own fees up-front or use a HELP loan to pay for their studies. A default is where the provider closes, stops offering a course or unit of study, or fails to start a course or unit of study that has been paid for.

The Tuition Protection Service (TPS) assists students to continue their studies or receive a refund of their tuition fees or have their HELP balance re-credited if they used a HECS-HELP or FEE-HELP loan to pay for their studies.

For information about higher education tuition protection refer to our Statement of Tuition Assurance – Higher Education.

Local students (i.e. not on a temporary entry visa) may be eligible for student income support from Centrelink. Centrelink is the official Australian Commonwealth Government agency that assesses income, administers payments and ensures adequate distribution of information on benefits, allowances and pension payments as per the Social Security Laws.

Centrelink Income Support Assistance programs for students include Youth Allowance, Austudy and ABSTUDY. For further information, contact your local Centrelink.

scholarships

Scholarships

ACAP offer five categories of general scholarships, in addition to a fully funded First Nations Scholarship specific to the Graduate Diploma of Legal Practice course. ACAP has also been awarded the Australian Government Destination Australia Scholarship (DAS) for students undertaking a course on the Byron Bay campus.

Students should learn more about the Australian Government Tertiary Access Payment, which is a one off payment to help eligible students with the cost of moving from a regional area to study.

Student Services and Amenities Fee (SSAF)

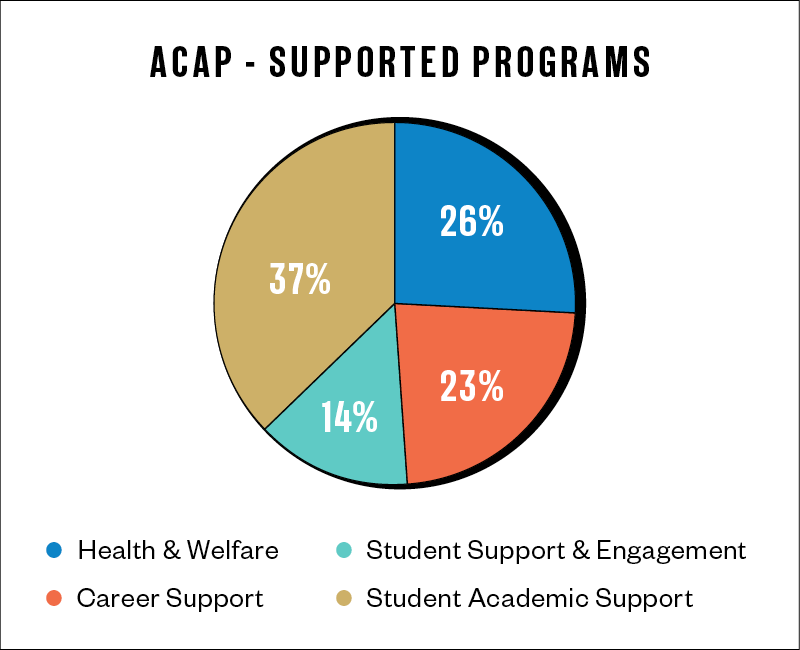

From 2024 eligible ACAP students will be required to pay the Student Services and Amenities Fee (SSAF), to support a wide range of non-academic student services, facilities and student-focused initiatives.

This government-approved fee is levied on all eligible students to allow us to allocate specific funding for services and activities that support students’ physical, mental, social, career and cultural wellbeing. The Higher Education Support Act 2003 (HESA) and the Student Services Amenities, Representation and Advocacy Guidelines (the Guidelines) outline how the funds are allocated, spent and reported.

SSAF-supported services will be available to all ACAP students, regardless of how and where you study, and we encourage you to take full advantage of them to enrich your College experience.

SSAF KEY INFORMATION

The Student Services and Amenities Fee is a Commonwealth Government legislated fee charged by many higher education providers across Australia to help fund support services for students of a non-academic nature, including recreational activities, accommodation, community events, student publications, and career and employment advice.

For more information on the SSAF in Australia, visit the Australian Government SSAF website.

The SSAF funding model is designed to achieve maximum benefit for the most students. It allows ACAP to use the collective contributions to fund as many programs as possible to support different students with a variety of needs across the entire student cohort, such as:

- Counselling services

- Careers and leadership development and advice

- Health and wellbeing services and promotion

- Helping secure student accommodation

- International Support

- IT services

- Financial support

- Food and beverage provision at college events

- Orientation

- Student amenities

- Student advocacy and legal services

- Student communications

- Student services, support, activities and events

- Supporting sporting, recreational and cultural activities.

All enrolled ACAP students will pay the SSAF, however there are some exceptions:

- Students on 100% scholarships

- Navitas staff

- Students who began studying before January 2012

- Students in VET, non-award courses, and short courses (up to 16 weeks’ coursework)

Note: This exemption list may be amended in future trimesters.

The 2024 Student Services and Administration fee for ACAP is up to $326 for full-time students. The fee will be charged per trimester at:

- $108.00 for full-time students (FT = study load of 0.25 EFTSL and above)

- $81.00 for part-time students (PT = a study load below 0.25 EFTSL)

Liability for the SSAF is based on enrolled study load as at each census date.

The SSAF will be a compulsory charge for all students enrolled in a higher education course.

The payment date or the date that the debt is incurred for SSAF is on census date, however cannot be earlier than the last dates students are able to enrol in a course. Eligible students who wish to access SA-HELP must complete a ‘Request for SA-HELP’ on or before the date payable. Contact Student Services for more information about accessing this form. SSAF can be invoiced before census date but liability is incurred as of census date.

The maximum annual SSAF that can be charged is determined by the Commonwealth Government. This is currently up to $326 for a full-time student. Students studying on a part time basis cannot be charged more than 75% of the maximum amount that the students studying on a full-time basis are charged. The fee may be indexed annually.

The SSAF can be paid via up front or by deferring the fee.

Option 1: Pay upfront

If you are a domestic student, we will send you an invoice each trimester that requires you to pay the fee by that trimester’s census date. If you’re an international student, you’ll need to pay your SSAF upfront, by that trimester’s commencement date, with a refund provided to any student who withdraws prior to census date.

Option 2: Defer your fees through SA-HELP

Eligible students who are enrolled in an award course may choose to defer part, or all, of their fees through SA-HELP. All other students must pay their fees upfront, directly to ACAP.

To defer the SSAF you need to complete a ‘Request for SA-HELP’ form. Students who use SA-HELP will be required to pay their SSAF debt through the tax system when they earn above the minimum threshold for compulsory repayment, in the same way that FEE HELP works. Forms are available from the Student Engagement team.

Remember, if you are eligible and are going to defer your SSAF, you need to do this before the required payment date.

When you haven’t paid or deferred your SSAF payment, you can expect to receive reminder notifications following the SSAF deadline at Census.

The SSAF is a compulsory charge – if you have not paid your Student Services and Amenities Fee (SSAF) instalment invoice by the payment due date penalties will apply as outlined in the Tuition Fee and Refund Policy.

SSAF Proposed Spend 2024

We have spoken to our students and they have told us how they would most like to see their SSAF dollars spent.

All students will continue to have the opportunity to contribute to the decision-making process for future SSAF spending, including through democratically elected student representatives from Trimester 1, 2024.

We have published details of these priorities below.

Support from Academic Skills Advisors and the 24/7 national online resource, Studiosity, to help students develop and improve their core academic and study skills.

Increased support for students’ wellbeing, including student counsellors, the Student First Wellness Strategy, and a dedicated part-time social worker to advise and assist on social welfare matters such as health, housing and finance.

Creation of new career advising services and industry engagement measures to assist students and graduates with future employment opportunities in their chosen field, including support from full-time careers advisors, and the design and implementation of employment strategies.

An expansion of ACAP’s learning and professional counselling services, and specific resources for international students to help with assimilation into Australian life, as well as student-led activities, such as increased student campus and offsite activities for all students, and enhanced orientation and information packs for new students.

SSAF Frequently asked questions

The SSAF model allows funding to areas which would not normally be allocated through operational costs or cannot be funded due to legislation or education guidelines. It allows ACAP to allocate funding to services, facilities and student-focused initiatives that would otherwise be unsupported or unable to go ahead.

Services provided through the SSAF funding are made available to all ACAP students, and it is up to each individual student to choose their level of engagement with these services and activities.

SA-HELP is a Commonwealth loan available to eligible students to pay their Student Services and Amenities Fee (SSAF).

Your Student Services and Amenities Fee (SSAF) is not covered under FEE-HELP. However, eligible students may apply for SA-HELP to pay for all or part of the SSAF.

Contact Us

For more information about the SSAF call 1800 061 199, or email [email protected].

Have Your Say

We welcome and encourage feedback from students on our SSAF processes. Have your say by emailing us at [email protected].